Updated August 7, 2024, at 3:10 PM

When clients buy a life insurance policy, many view it as a set-it-and-forget-it product that’ll be there when they need it.

And while that lends some truth in certain situations, it’s also worth noting how much life—and life insurance needs—can change over time.

That’s why it’s imperative to conduct life insurance policy reviews regularly.

Life insurance policies are assets, and like any assets, they should be reviewed often to make sure your clients are optimally protected.

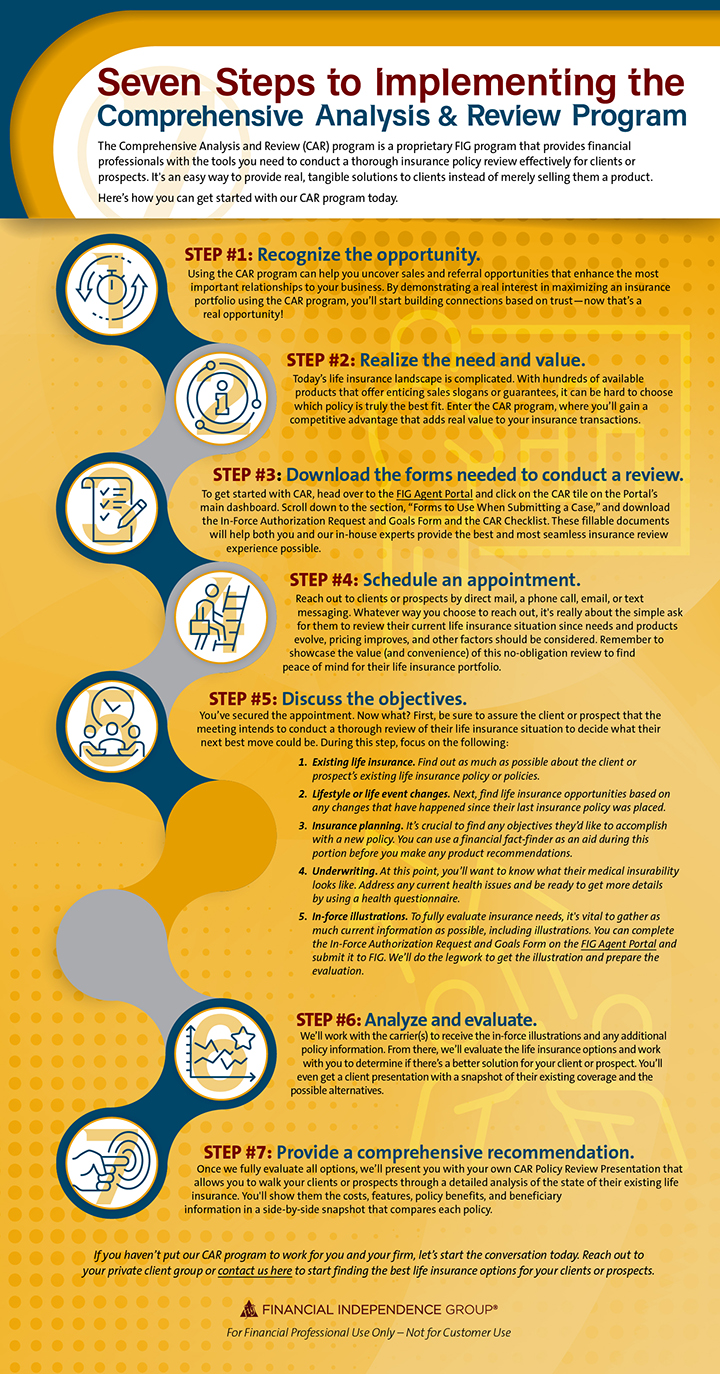

With our easy-to-implement Comprehensive Analysis and Review (CAR) program, you can add value to your practice while enhancing your most important relationships with an efficient life insurance policy review.

It’s recommended to consistently conduct life insurance policy reviews to make sure:

- All current goals and objectives are met.

- Changes in lifestyle or health are accounted for.

- Life insurance coverage is competitively priced.

- The amount of life insurance aligns with clients’ overall goals.

- The life insurance policy is performing well.

If you’re interested in getting started with life insurance policy reviews, check out the infographic below (or download it here) to see how easy it can be with our CAR program. All that’s needed from you today is to recognize the opportunity ahead of you.

Related: CAR Program: Life Insurance Concepts

Keep Reading: Q&A: Life Insurance Policy Reviews

For Financial Professional Use Only

The content within this post is for educational purposes only and does not represent legal, tax, or investment advice. Customers should consult a legal or tax professional regarding their own situation. This presentation is not an offer to purchase, sell, replace, or exchange any financial product. Insurance products and any related guarantees, features, and/or benefits are backed by the claims-paying ability of an insurance company. Insurance policy applications are vetted through an underwriting process set forth by the issuing insurance company. Some applications may not be accepted based upon adverse underwriting results.