Editor’s Note: This article is from our partners at LifeInnovators.com, and the PDF version can be downloaded for free here.

The Basic FILA Concept

As we covered in The Emergence of the Fixed Index-Linked Annuity (FILA), the core definition of a FILA product is an FIA that allows the policyholder to access index-linked crediting options that have more downside risk and more upside potential than a typical FIA and akin to what’s available in some RILA products.

However, unlike a RILA product, FILAs restrict access to crediting options with downside risk only to policies with sufficient previously tracked gains to withstand the worst-case negative credit without piercing the policyholder’s principal.

The concept itself is very simple: the policyholder can take as much risk as previous gains allow in order to get more upside potential. But is the product as straightforward as it sounds? For that, we have to dive a bit deeper.

The Multi-Year Indexed Crediting Account

In terms of the base product chassis – surrender charges, compensation, MVA formulas, and other base contract elements – FILA products are identical to traditional FIA products. The difference between a FILA and an FIA product is the presence of a multi-year indexed crediting account that does four things:

- It maintains a tracking value that starts with the initial premium allocation to the account and receives index-linked adjustments on an annual basis. The adjustments work identically to a typical index-linked credit on an FIA or RILA in that they apply to the full tracking value.

- It offers index-linked adjustment strategies with both positive and negative adjustments. Strategies with a 0% floor have FIA-like upside potential and strategies with negative floors have RILA-like upside potential.

- It restricts allocations to the strategies with negative adjustments and greater upside potential based on previous adjustments to the tracking value as calculated by the maximum sustainable loss. This is referred to as the tracking value at risk (TVAR).

- At the maturity of the multi-year indexed crediting strategy, the indexed credit makes the account value equal to the tracking value. In math terms, the final indexed credit is tracking value/account value -1.

Related: Annuities & Peace of Mind

The Tracking Value at Risk Calculation

At the heart of the FILA concept is the TVAR mechanism to restrict the availability of strategies with negative adjustments only to policies with sufficient gains in the tracking value.

TVAR isn’t a part of the actual calculation of indexed credits in any way. It’s simply a way to limit the allocation choices available to each policyholder based on their specific policy values and, without it, FILA could not exist.

The actual TVAR calculation answers a simple question: what’s the maximum negative credit that the tracking value could receive without falling below principal? In mathematical terms, the answer is a simple ratio: 1 minus account value divided by tracking value.

Example: A policy with $100,000 in account value and a tracking value of $125,000 has a TVAR of 16.67%.

Applying TVAR to Strategy Allocation Choices

As a simple rule, a policyholder can only allocate to strategies where the TVAR is larger than the maximum negative index-linked adjustment. For example, if the maximum loss for a particular strategy – regardless of whether it uses floors, buffers, or participation rates to calculate the loss – is 10%, then only policies with TVAR greater than or equal to 10% can allocate to that strategy.

Crucially, FILAs allow the policyholder to allocate to any strategy with a maximum loss that’s less than or equal to TVAR, including the core 0% floor strategies.

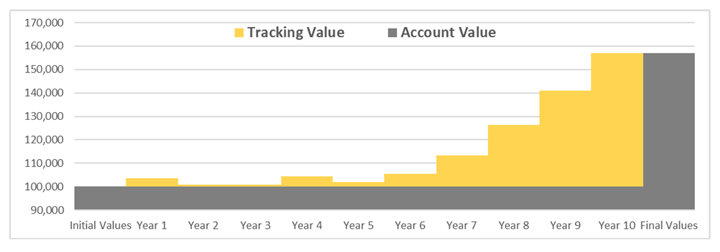

FILA Mechanics Example

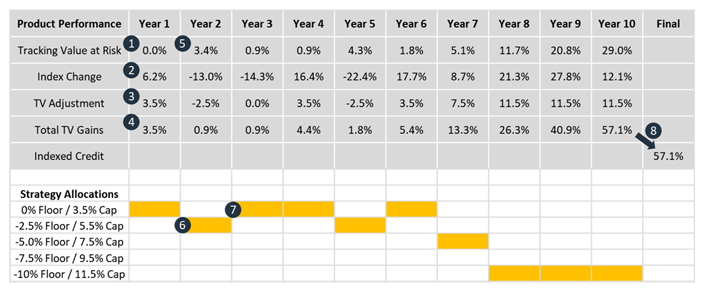

With just these core elements and mechanics, we can bring the basic concept of a FILA to life. For this example, we’re going to assume that the product has five S&P 500-based strategies within the multi-year indexed crediting account, all of which use annual point-to-point crediting with a cap at the specified floor level.

FILA Mechanics Explanations

- The TVAR is initially 0% because there are no gains and, therefore, nothing to put at risk.

- The index change can use any index or payoff found in a traditional FIA and, in this case, is 6.2%.

- The index change is capped at 3.5%, as it would be for any traditional FIA with a 3.5% cap.

- At the end of the first year, total gains to the tracking value (TV/AV-1) stand at 3.5%.

- TVAR is calculated (AV/TV-1) at the end of year one and, in this example, is 3.4%.

- The tracking value can be allocated – if the client chooses – to the -2.5% floor strategy because TVAR is large enough to sustain a full negative credit without going below zero.

- The second year has a negative index change and, therefore, reduces TVAR so that the tracking value is allocated back into the 0% floor strategy.

- This process of receiving index-linked adjustments, calculating TVAR, and reallocating the tracking value to the available strategies repeats every year until the end of the final year of the indexed crediting account. At that point, the final indexed credit is equal to the gains in the tracking value over the life of the account divided by the account value.

Related: 64 Problems, 1 Annuity Solution

FILA Mechanics Q&A

Q: Are caps, participation rates, spreads, floors, or buffers only to gains or to the whole tracking value?

A: In FIA and RILA products, any of the above elements always applies to the full account value allocated to the particular crediting strategy. With FILA, the account value in the multi-year crediting strategy only receives an indexed credit at the end of the account term, but the tracking value receives index-linked adjustments at least on an annual basis.

Any cap, participation rate, spread, floor, or buffer is applied to the full tracking value allocated to the particular strategy. The sole and solitary purpose of tracking gains is that the final indexed credit to the multi-year indexed account is equal to the gains in the tracking value as a percentage of the account value.

Q: Is the policyholder required to allocate to any particular account?

No. At least, there’s no mechanical reason why the client would have to. One of the most powerful and attractive features of the FILA chassis is the choice and flexibility that it gives to clients in selecting their desired risk and return profile on an annual basis.

However, it’s most likely that life insurers introducing FILA products will allow the client to set a maximum desired risk level when the policy is issued and that can be changed prior to any policy anniversary so that the allocations can be automatically selected up to the maximum specified risk level.

For example, a client could set a maximum risk level of a -10% credit and the FILA would automatically allocate the tracking value to accounts with risk up to -10%, depending on what’s allowed by TVAR.

Q: How do withdrawals affect the mechanics of the multi-year account?

There are a variety of ways that withdrawals could be treated under the FILA concept, but withdrawals don’t fundamentally change the mechanics of the account. Any withdrawal would be deducted either on a pro-rata or dollar-for-dollar basis from the account value that’s been allocated to the multi-year indexed crediting account.

The new, reduced account value would continue to be used to calculate TVAR and, therefore, which strategies are available for allocation. TVAR is almost always increased as the result of a withdrawal.

Q: How are values calculated between policy anniversaries?

Because FILAs involve the potential for negative adjustments, the tracking value will likely be adjusted on a daily basis to take into account the constant movement of the index. As with RILA products, the exact formula for translating index movements into intra-year adjustments to the tracking value will vary by the carrier.

Q: Is the full tracking value available for withdrawal or surrender?

No. At least from our vantage point, it shouldn’t be. Although the tracking value could serve as the basis for free withdrawals, non-free withdrawals, full surrender, and on death, it’s a part of a multi-year crediting strategy and there will likely be gains in the tracking value that can’t be accessed immediately and either are available only at the end of the term or vested over time.

We expect that companies will differentiate their FILA offerings at least in part based on the degree to which the tracking value is available for policy transactions prior to the end of the multi-year indexed crediting strategy.

Q: How are FILA rates set and hedged?

As with any other FIA product, FILA is hedged using options on the underlying indices used for index-linked crediting. The non-guaranteed elements of the crediting strategies – the participation rates, spreads, and caps – are adjusted on an annual basis depending on the market price for options. Rates in FILAs should mirror rates in FIA products for the same 0% floor and rates in FILAs should resemble rates in RILAs for the same downside risk.

Keep Reading: The Emergence of the Fixed Index-Linked Annuity (FILA)

To learn more about FILAs and other independent life insurance

and annuity product developments, click on the Life Innovators logo below.

Copyright Life Innovators LLC 2021