Updated October 3, 2025, at 2:36 PM

Major change is coming in the world of indexed universal life (IUL). In May 2023, the next round of revisions to Actuarial Guideline XLIX (AG 49) came to life, which went into effect in 2015. This was the first in a series of regulations directed toward taming IUL illustrations, though this year’s revisions will likely be the last for the time being.

While these regulations may seem to put IUL directly in the line of fire, it’s important to note that none of these changes affect the real-world performance of these products; the changes only affect what carriers can show on a hypothetical illustration. The illustration is under scrutiny, not the product itself.

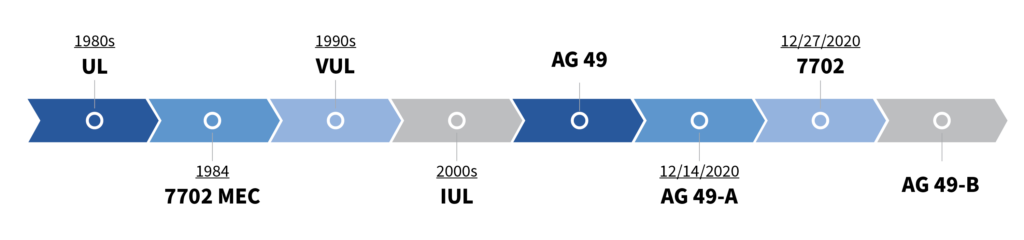

Since the 1980s, cash-value life insurance has been caught in a tug-of-war matchup between insurance carriers and regulators. Taking advantage of the favorable tax treatment of life insurance, universal life (UL) debuted in the late 1970s. By 1983, the strategy was adopted by most major carriers in the space. That’s when regulators stepped in with IRS Section 7702, setting clear parameters around the taxation of life insurance policies.

AG 49 Podcast: The Latest in Life Insurance with Teresa Speir

In tandem with the Technical and Miscellaneous Revenue Act of 1988 (TAMRA), 7702 helped establish guidelines for a definition of life insurance and what qualifies as a modified endowment contract (MEC). When IUL entered the scene in the late 1990s, it took both sides a bit longer to figure out what they were working with this time.

Welcome AG 49-B to the Playing Field

In May 2023, the next piece of regulation, AG 49-B, hit the world of life insurance, focused solely on IUL. This isn’t the first time that IUL has been the focus of pending legislation. In 2015, we saw Actuarial Guideline XLIX (AG 49) institute a uniform measure for calculating a product’s maximum illustrated rate. AG 49 also restricted the illustratable loan arbitrage to 1.00%. In response, insurance carriers began including internal bonuses and various other measures to artificially boost the rate of return (for more details, see my article Credit vs. Cost: Understanding IUL in the Aftermath of AG49).

That idea earned us a sequel to AG 49. That sequel, deemed AG 49-A, aimed at cracking down on these non-guaranteed bonuses. It also further limited loan arbitrage to 0.50% on illustrations. This change went into effect on December 14, 2020. AG 49-A and a major revision to the 7702 that snuck its way through in the same month meant that death benefits on cash-value-oriented policies would be the lowest they had ever been since the adoption of MEC guidelines in 1988.

Related: Regulatory Changes from AG 49-A & Section 7702

Impacts on IUL Illustrations

All of this led to an odd January 2021. To no one’s surprise, the COVID pandemic made for a record-setting year for life insurance sales. Many insurance carriers struggled to keep up with the demand. Expected timelines for placing business were climbing rapidly.

With a smaller loan rate arbitrage, IUL illustrations which included distributions were projecting less income to the client. On top of this, agent compensation for these policies saw a decrease due to the new 7702 guidelines. Put all of this together, and it’s not difficult to see that agents were not quite as excited about selling IUL.

At this point, you might be wondering what IUL did to hurt the National Association of Insurance Commissioners (NAIC). On the surface, it might feel as though IUL has been the consistent target of the most significant regulations generated by NAIC over the past decade. With AG 49-B capping off the least-anticipated trilogy in modern cinematic history, there’s some truth to this.

IUL has been an industry disrupter, creating new ways to position life insurance and leading the charge in product innovation. It has captured much of the market previously occupied by variable and whole life insurance. If you ask me, the kind of disruption that IUL has created deserves scrutiny.

With each new regulation, IUL has rolled with the punches. Each wave is met with creative new ways to position the product. In response to the original AG 49, we got non-guaranteed bonuses and multipliers. That’s what AG 49-A addressed. With AG 49-B, we’ve seen carriers lean more on volatility-controlled index accounts (VCIA) and strengthen the guarantees on any bonuses and multipliers.

A decade ago, virtually all IUL products defaulted to illustrating an annual point-to-point S&P 500 index. Currently, you’d be hard-pressed to find a product with the S&P 500 set as the default allocation. Everyone is leaning on volatility-controlled indices, which are more cost-effective and allow more room for play with bonuses and multipliers.

Related: IUL Fees, Costs, & Illustration Manipulation Explained

Cue New Revisions to AG 49

As each carrier has introduced its own flavor of volatility control, comparing products side-by-side has become increasingly more difficult. Many of these new proprietary indices were unfamiliar to agents and clients alike. None were as simple and easy to track as the S&P 500. In truth, none were expected to perform like the S&P 500.

A 5.00% return in a volatility-controlled index isn’t equivalent to a 5.00% return in an S&P 500 index or even another volatility-controlled index. Depending on what allocation you choose, 5.00% can mean an effective rate of return of 5.00%, or it could mean 6.00%. Or 7.00%? This all depends on the bonuses built into the calculation of that index.

Confused yet? So was the NAIC.

To curb these illustration feuds, the 2023 AG 49 revisions attempt to regulate these illustrated rates better. The original AG 49 set the S&P 500 as the standard for calculating the maximum rate that a carrier could show. This year we’re seeing a return to this mindset, adding the carrier’s hedging cost into the equation.

Now, illustrated rates for volatility-controlled indices must consider the same leverage used for the benchmark index account (S&P 500). On top of this, bonus rates will be limited to the difference between the carrier’s annual net investment earnings rate and their actual hedge budget.

This can get convoluted, so it might be easier to examine a few different scenarios. Consider the following two hypothetical indices under the current regulation:

| BIA | VCIA | |

|---|---|---|

| Earnings Rate | 5.00% | 5.00% |

| Hedge Budget | 5.00% | 3.00% |

| Cap | 12.00% | Uncapped |

| Index Bonus (Multiplier) | 0.00% | 2.00% |

| Max Illustrated Rate | 7.50% | 7.50% |

| Max Rate + Bonus | 7.50% | 9.50% |

| Illustrated Leverage | 150.00% | 250.00% |

As you can see here, the illustrated leverage (max illustrated rate ÷ hedge budget) is significantly higher in the volatility-controlled index account. Because these indices typically require a noticeably smaller hedge budget, it’s not uncommon to see much greater illustrated leverage as a result.

Under the new regulation, the VCIA will be limited to that same leverage. Here’s what that same scenario would look like after May 1, 2023:

| BIA | VCIA | |

|---|---|---|

| Earnings Rate | 5.00% | 5.00% |

| Hedge Budget | 5.00% | 3.00% |

| Cap | 12.00% | Uncapped |

| Index Bonus (Multiplier) | 0.00% | 2.00% |

| Max Illustrated Rate | 7.50% | 4.50% |

| Max Rate + Bonus | 7.50% | 6.50% |

| Illustrated Leverage | 150.00% | 150.00% |

The new max illustrated rates for volatility-controlled indices will ultimately be reduced across the board. This in no way affects the actual performance of these index allocations.

However, it does affect the potency of the sales illustration. With AG 49-B, we’re going to see a reduction to illustrated performance for accumulation, distributions, death benefit – everything – when using a VCIA.

Is IUL Under Attack Due to AG 49-B?

Maybe. Sometimes it feels that way. However, in truth, what’s really under attack here is the illustration. The products aren’t changing.

What they can do to protect individuals and families is staying the same. IUL as a tool in your client’s financial plan isn’t changing. What needs to change is how we’re utilizing these illustrations. Perhaps in the future we can change the illustrations themselves. We all know they’re due for a refresh.

Keep Reading: 7 Steps to Implementing the Comprehensive Analysis & Review Program

The content within this article is for educational purposes only and does not represent legal, tax or investment advice. Customers should consult a legal or tax professional regarding their own situation. This presentation is not an offer to purchase, sell, replace, or exchange any financial product. Insurance products and any related guarantees, features and/or benefits are backed by the claims paying ability of an insurance company. Insurance policy applications are vetted through an underwriting process set forth by the issuing insurance company. Some applications may not be accepted based upon adverse underwriting results.