Financial advisors who use email marketing can build more profound, trustworthy relationships through valuable education and lead nurturing.

We’ve seen partnered advisors generate over 30 new appointments and over $2 million in new assets under management (AUM) from a single, five-part email campaign that drives prospects to register for a webinar.

But what if your emails aren’t consistently bringing in new business? Instead of getting prospects and clients to engage with you, what if you’re making them indifferent to your services?

The average click-through rate for financial services is 2.4%. That’s not bad, but that number could rise if you’re going about your emails correctly.

These nine email marketing tips for financial advisors are simple to implement and can be easy “wins” that earn you more business.

Email Marketing Tips for Financial Advisors

Tip #1: Each email should have one clear objective.

It’s tempting to highlight all the excellent services you offer to your audience at once, but don’t fall for that trap.

Throwing everything but the kitchen sink into an email isn’t advised. You’ll be more effective in your email marketing if you have one clear objective for each email. For example, one email objective could be downloading your “annuity starter’s guide.”

Too many calls-to-action (CTAs) can compete with each other to the point that it confuses readers and results in them taking no action at all. Those who study consumer behavior call that a “choice overload.”

A 2000 study confirmed the impact too many choices have on consumers and how it demotivates them. Each email you send should have one specific goal and one specific CTA to entice and convert more of your audience.

Tip #2: Optimize your sender name.

Here’s an interesting tidbit from our friends at Litmus: they found that your sender name—and not the subject line—has the biggest impact on whether a recipient opens an email. In fact, 42% of recipients check the sender first when deciding to open an email.

So what does that mean for your email marketing as a financial advisor?

Test your sender name for a few weeks or months to see which one performs best. If your brand is well-known, you may be able to use your company name as the sender.

Or, you can make it come from you, the advisor. Alternatively, you could combine the two. Say your company name is Wealth Growth; instead of emails from “Jane Doe,” they could come from “Jane From Wealth Growth.”

This is an easy task but requires some simple testing. The results may surprise you.

Related: Building Your Brand: Content Promotion Tips for Financial Advisors

Tip #3: Test your timing.

When you send your emails is just as important as who it comes from and the content itself. Because if your email hits a recipient’s inbox when they don’t have time to take action, they may never get around to it.

When to send your emails isn’t black and white, though. Some research suggests 2:00 PM is the best time. Some suggest 8:00 PM, while others say 9-11:00 AM is best. You’ll need to experiment with your send times to see which time of the day produces the best results.

The same goes for the day of the week. Popular thought in email marketing is that Tuesdays and Thursdays are best, which often can be the case. But just like the time of day, testing will be needed to see which day of the week resonates best with your audience.

For example, here at Financial Independence Group, we’ve noticed that Fridays perform better for some of our email lists while Tuesday-Thursday works well with other audiences. You’ll need some simple testing to determine what time and day resonate best for your emails.

Tip #4: Include the same link a few times in your emails.

Not to be confused with multiple different CTAs, having the same link—whether for a content download, event registration, or to fill out an interest form—can help drive people to take action.

So if your main goal for an email is to register for an upcoming webinar, have the webinar registration be a clear CTA button at the end of your email. But, you can also include that link in the text of your email, too.

For example, you could include the link to register where the bolded italic text is below:

- Our upcoming webinar, How to Know if Life Insurance is For You, is almost here!

- Make sure you register today to get your spot to learn about the various types of life insurance and how one may fit your financial planning needs.

This technique can help pique curiosity and lets your audience take action without having to read the entire email.

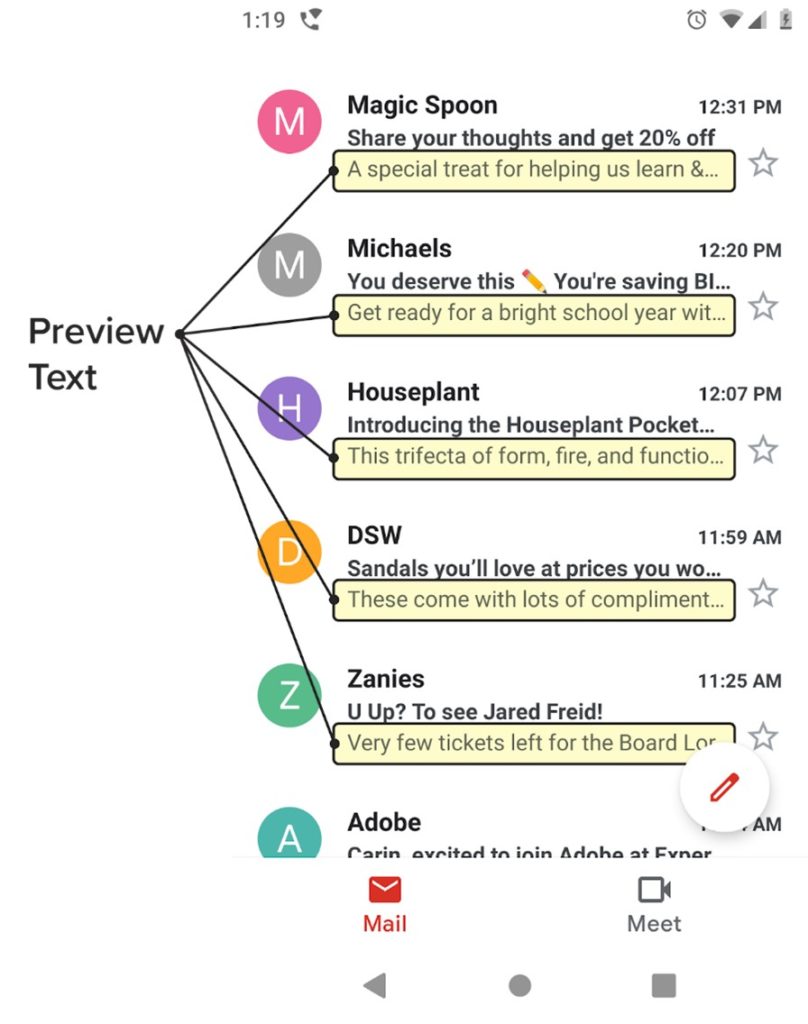

Tip #5: Take advantage of your preview text.

Preview text lets recipients get a glimpse of what’s in store when they open the email before they even open it. A Litmus article says that 24% of people look at an email’s preview text before deciding to open it. The yellow boxes below highlight where the preview text is in a Gmail account.

Many email marketing solutions have a standard preview text that instructs how to read the email online or view images. Doing this wastes valuable email real estate. Instead, editing your preview text for each email sent gives you opportunities to:

- Summarize what your email is about

- Include a CTA to increase open rates

- Include a secondary subject line

#6: Segment your email lists.

Not all your offers are intended for everyone, so it makes sense to segment your lists to engage those more likely to act. Separating your lists by client type, service type (annuities, long-term care, life insurance), or any other segmentation can prevent you from annoying people with irrelevant emails.

Email segmentation also lets you create a more targeted approach to hit the inboxes of those who you know are more interested in a specific email than others. Some HubSpot data suggests companies that segment their email lists see 18% more transactions, 24% more leads, and a 24% increase in revenue.

Related: Client Segmentation Guide for Wealth Management Firms

Tip #7: Don’t over-send, don’t under-send.

There’s a fine line between emailing too much and emailing too little. Well, maybe it’s not such a fine line.

People can get annoyed or unsubscribe from your list if you send too many emails. Getting an email every day can be overwhelming, and you could lose engagement with your audience.

On the flip side, sending an email once or twice a quarter is too little. Losing contact with your audience for weeks on end can make them stop opening your emails altogether. Not to mention, it gives them ample opportunities to find a competitor who’s willing to engage them.

Different brands and industries vary for the best email frequency. A good rule of thumb to follow from Databox is sending emails somewhere in the ballpark of once or twice a week to a few times a month.

Tip #8: Use social proof.

The proof is in the pudding, right?

Satisfaction is infectious, so use that to your advantage. Social proof is the idea that people tend to copy the actions of others to reach the same goal in a given situation.

Adding social proof to your emails like a business review or client testimonial (if compliant) can make your email recipients feel more confident taking action in your emails, knowing that it may solve their problems.

Another form of social proof could be shown through statistics, like this example: “In our annual client survey, over 92% of our clients were satisfied or very satisfied with our level of service.”

Tip #9: Always be testing.

Or what some of us marketing folks like to say, “ABT.”

Email marketing for financial advisors is an ongoing experiment. And the best way to get the highest results from your emails is to test everything to see what resonates most.

You may have ideas on what should work with your audience, but you won’t know what does work until you test your options. A/B testing, or comparing two different versions of an email to see which performs better, is an excellent way to find out what works best with your audience.

Be open and flexible with your email strategy, and don’t be afraid to test out any of the following variables:

- Email layout

- Subject lines

- Images in emails

- Email copy

- CTA colors and buttons

- Sender name

- Preview text

- Email personalization

- Send time and date

Email Design Tips to Remember

Now that you have nine actionable tips on email marketing for financial advisors you can implement in your email strategy, let’s cover a few quick email design tips to create emails that appeal to the human eye.

Email design tip #1: Use single-column layouts.

A single-column layout is probably the easiest email design, but it’s also effective. Implementing a single column instead of two or three columns helps readers visually “lock in” to the email’s content and allows for easy comprehension.

Email design tip #2: Keep the email short.

As much as we’d like to think every word in our emails is read, that usually isn’t the case. There’s no absolute rule for email length, but generally, the shorter the email, the more straightforward it is. That can lead to higher click-through rates and overall performance.

Email design tip #3: Increase your white space.

Remove the clutter. If your emails are heavily designed with dense paragraphs, try increasing the white space. When text and images are adequately spaced out, readers can more easily progress through the email’s components without distraction.

Email design tip #4: Utilize visual hierarchy.

We keep hitting on the visuals that readers see, but it’s because it matters. Consider a visual hierarchy in your emails using headlines, images, and color to direct your readers’ attention to the main goal or CTA.

Email design tip #5: Passing the squint test.

Unsure if your email design is on the right track? Try testing it using the squint test. It’s what it sounds like—squinting at your email to determine how many distractions there could be.

When using the squint test, you’re looking for your CTA to stand out from the rest of your email content immediately. If it doesn’t, try removing or adjusting the components competing with your CTA button.

Related: Webinar Best Practices for Financial Advisors

Reminder About Compliance

While these email conversion and design tips can help improve your firm’s marketing performance, it’s important to stay compliant and follow the obligations that apply to your business.

If you’re a registered advisor and want to implement any of these tips, be sure to work with your BD or RIA to adhere to the marketing and advertising rules set forth from their compliance requirements before pressing “Send.”

Final Thoughts on Email Marketing for Financial Advisors

Email marketing is a cost-effective and active way to educate, engage, and convert your audience. By implementing even a handful of these tips, your email marketing efforts can help drive new business to your firm.

If you’re a partnered FIG financial professional, click below or contact your private client group or marketing strategist to discuss ways we can help you increase your email marketing performance.

Keep Reading: Financial Dinner Seminar Best Practices to Drive More Business

For Financial Professional Use Only