The landscape of the life insurance industry continues to evolve in 2021, as we had expected. The relief bill put out by Congress at the end of 2020 enacted several (somewhat unexpected) changes to the life insurance industry, the primary change being an update to Section 7702 of the Internal Revenue Code. As a reminder of what Section 7702 is and what those changes entailed, below is an excerpt from my last article.

Section 7702 Overview

Section 7702 is the section of the Internal Revenue Code that defines what the US government considers a legitimate life insurance contract and the taxation of that contract. Staying within the guidelines of Section 7702 is a crucial element to having access to several significant tax advantages that are inherent in a life insurance policy. Regarding the cash value in a life insurance policy, staying within the Section 7702 guidelines can provide access to the cash value inside a life insurance plan with significant tax advantages. In many cases, the cash can even be accessed income-tax-free. The problem was that Section 7702 created a conundrum for whole life contracts. When the guidelines were set for a “guaranteed interest rate” under 7702 (in the mid-1980s), interest rates were generally pretty low, and the IRS didn’t foresee rates dropping much further, if at all.

So the IRS set a “static” rate of 4% to the mandated minimum interest rate a whole life policy had to guarantee. Well, interest rates did fluctuate, and yes, they did drop from those mid-1980s levels. We all know how low interest rates have been recently and how long they’ve been incredibly low. Whole life carriers were suffering from providing good solid products, as they had to guarantee a 4% rate of return when it was next to impossible to generate that type of return anywhere in the market. This created a severe lack of flexibility in whole life products that had to adhere to these 7702 guidelines.

Enter 2020 and the COVID-19 pandemic (and the economic tumult that ensued). It became evident that interest rates were going to remain low for the foreseeable future. Near the end of 2020, Congress put together a relief bill, essentially to help the American public with problems created by the pandemic. Many elements of this spending bill were added (and some would say sneakily added) at the eleventh hour, and the bill passed through Congress at the end of 2020, with very little fanfare. One part of this spending bill included changes to Section 7702. The primary change was that the guaranteed minimum interest rate could now be fluid and no longer set at a static, unchanging 4%. It made sense to make the change. It’s just interesting to many in the industry why it was so covertly hidden in the bill at the last minute.

Related: It Was the Best Of Times, It Was the Worst Of Times: Regulatory Chances From AG 49-A and Section 7702

Nevertheless, it was, and now guaranteed rates are lower and more flexible. The details behind what this change will bring are complex, but I’ll attempt to summarize it: The benefit this change will bring about is much more flexibility, not only in whole life contracts but also in all permanent contracts. Because of the lower mandated guarantees now required, there’s much more flexibility in premium paying. In a nutshell, for those wanting to maximum fund their permanent life insurance plans, the amount of premium they can now put in (and still stay within Section 7702 guidelines) just went up significantly.

So, in other words, those wishing to use life insurance to build tax-advantaged cash values can now put in much more premium than they could before the change. That’s the upside. There’s a downside, too. For whole life, the downside is evident. With guaranteed rates being lower, so will guaranteed cash values. So one of the most advantageous elements to owning a whole life contract (the guaranteed cash values) will no longer exist. Is that a big deal? Only time will tell. The other downside of Section 7702 is directed to those of us selling these plans. Even though the amount of premium the IRS allows to fund these plans is increasing, the structuring of these plans under the new guidelines will force the death benefit to drop.

This, in turn, reduces the target premiums and hence commissions. The lowered death benefits can also be considered a downside to the change, but in most cases, the death benefit isn’t a primary consideration when max funding these plans.

Challenges to Section 7702

So, in 2021, the challenge to all life insurance carriers has been implementing the new Section 7702 rules to their particular products. Actuarial data has been significantly altered from the updates to Section 7702, and this data is reflected in the carriers’ illustration software. Now, this isn’t a new development for insurance companies. They have to update their illustration software all the time, typically when they have a rate change or their COIs need to be updated, or when they introduce a new product.

So, this shouldn’t have been a monumental upheaval for the software gurus of these insurance companies. However, these particular updates are significantly different than what they’re used to, so insurance companies were given a fluid timeline to complete their software updates. As of May 2021, roughly 40% of the major insurance carriers had updated their illustration software, leaving 60% of the carriers still scrambling to make their changes. Most are expected to update their software before summer ends.

However, some carriers aren’t likely to implement the changes until the fourth quarter of 2021. This may be a deliberate delay on the part of some carriers, as we’ve noticed a trend with the carriers that have already updated to reflect the changes.

Trends We’re Seeing from Section 7702 Changes

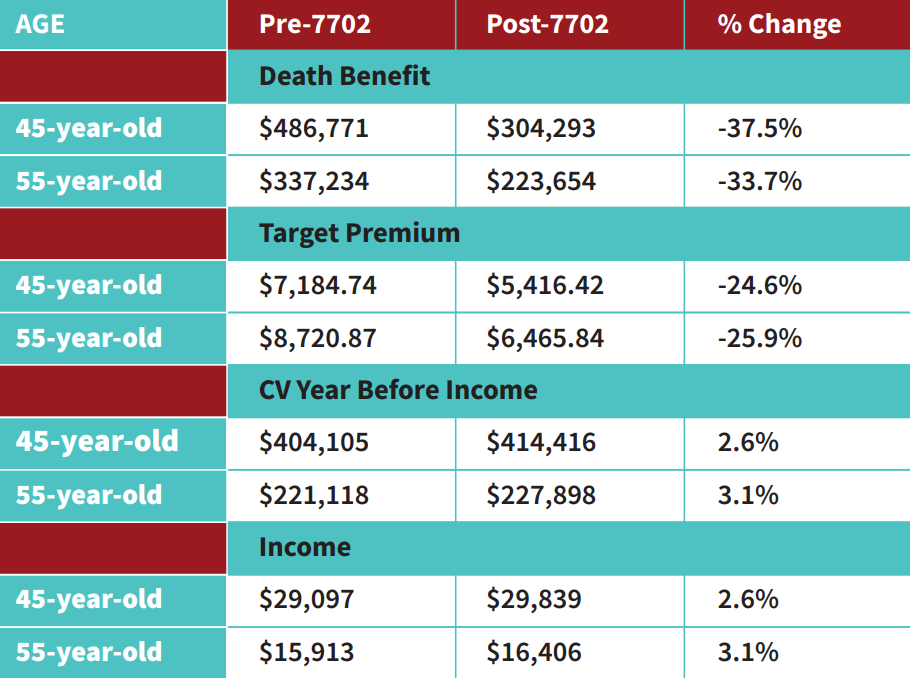

Here’s what we’ve noticed: when solving for maximum cash value and the minimum death benefit (maximum funding up to the MEC limit), the death benefits have dropped drastically. The target premiums have also dropped significantly, and the cash values and income streams have increased somewhat, but overall have remained relatively stable. Below is a solid example using one of the top IUL carriers in the industry.

Related: Is Cash Value Part of the Death Benefit? [Infographic]

As you can see, the death benefit dropped by over one-third! The target premium decreased by roughly 25%, which means commissions are dropping by that amount as well. The cash value and income did increase, but only by about 3%, which doesn’t seem like a fair trade-off compared to the smaller death benefits and commissions. This trend is consistent with the other carriers who have already adopted the changes, and we expect it’ll be the same with those who will be making their updates in the near future.

It may be possible that some carriers are holding off on making the Section 7702 changes so that they can increase their competitiveness (relative to those carriers who have already made the changes) in the next few months. Their targets and death benefits will look better when compared to those who have made the changes already.

It’s also possible that some carriers are taking their time, trying to figure out ways to update their software to become compliant, but also to find ways to manipulate the software so they can outshine the others in the illustration game.

Going Forward with Section 7702

By the end of 2021, all carriers should be compliant with the new illustration guidelines. One thing is for certain, though: if the “past is prologue,” we’ll soon undoubtedly see insurance companies looking for new and innovative ways to beat their competition in the illustration game. And shortly after that, regulations will very likely again be enacted to do everything possible to level the playing field again.

It’s a game of cat-and-mouse that’s been played since the earliest stages of the life insurance industry and will inevitably continue, at least well into the foreseeable future.

So buckle up; it’s going to be an exciting ride!