There was a time when the term artificial intelligence (AI) only evoked mental images of sentient robots taking over the world, a plot point explored in countless movies over the years. This was before most of us had any personal experiences with AI in our daily lives; before the 2022 launch of ChatGPT catapulted AI to the top of every mind and headline.

Today, AI is impacting almost every industry in some capacity.

Whether you’re excited about AI’s potential or sick of the media buzz, it doesn’t change that AI has arrived in the financial advisory landscape and is here to stay. The question is: How will you embrace it?

More than six out of ten advisory firms have no plans to build or use client-facing artificial intelligence tools or predictive analytics models in the future.

To the forward-thinking financial professional, that statistic should sound like an opportunity to get ahead of the competition.

Let’s look at how AI is disrupting the industry and explore a specific area where you can implement this technology to transform your advisory practice today: care planning.

How AI is Disrupting the Financial Industry

Using AI for data aggregation and “number crunching” precision is the first obvious way financial professionals can implement the technology to improve efficiency. It’s also being used in fraud detection, compliance and security, and risk assessment.

Client engagement communication is quickly becoming a hot topic for AI’s improvement in the financial advisory space. AI chatbots may quickly take on the role of “co-planners,” chatting with clients to help them complete the preliminary planning work so they come to their next meeting ready to hit the ground running.

While more efficient computing and communication can alleviate some of the workload financial professionals face as business owners, it doesn’t replace the value of human face-to-face interaction with clients. Even if AI programs can predict trends and suggest risk-averse investment strategies, only a financial professional can gauge if those suggestions align with the client’s financial objectives and personal goals.

It’s important to note that the SEC has also implemented regulations ensuring transparency in use, testing, and technical standards.

Related: Unlocking the Future of Policy Management: Introducing the Lifecycle Manager

The Future of Care Planning with AI

Already, AI has made an impact on the long-term care (LTC) space. Innovations include implanted or worn devices that can track health and mental status, helping aging adults with an LTC need to live at home for as long as possible.

Future technology imagines AI-powered avatars as virtual in-home caregivers, assisting patients in navigating their daily routines and maximizing safety. However, this doesn’t currently exist in the marketplace.

While these advancements seek to address the needs of patients in the early stages of LTC, software is available today that aims to plan for care needs before they occur. Even better news: This technology was designed for financial professionals to administer the information.

Waterlily is a client-facing, user-friendly software that uses AI to predict an individual’s potential future LTC journey. By leveraging half a billion data points of healthcare and demographic information, the platform doesn’t just display broad generalizations. It projects specific numbers, including:

- The likelihood percentage of that client needing care

- The age at which it’s predicted to begin

- The timeline of how the need could evolve

- The family burden in hours

- The estimated cost of care

Reshaping the Care Conversation with Waterlily

When Lily Vittayarukskul, the co-founder and CEO of Waterlily, set out to create something to help families financially prepare for an LTC event, she realized that she needed financial professionals to be that liaison between the realization and the solution.

After speaking with financial professionals, she determined that their main pain point with the care planning discussion was the “realization” piece; in other words, their clients hadn’t yet realized that care planning was relevant to their lives.

70% of Americans aged 65 and over will develop an LTC need. Even though this is a well-known statistic, many believe they’re part of the other 30%.

The cost of care can be devastating to retirement savings without prior planning, but if clients don’t think they’ll need care tomorrow, why would they invest time or money thinking about it today?

Waterlily addresses this challenge by revealing a client’s personal likelihood of needing LTC and their family’s burden involved with that care, immediately bringing relevancy to the rest of the care planning conversation. The platform walks a client through creating a care plan, naturally progressing into the topic of funding for that care. This changes a financial professional’s approach to no longer focus on selling a product but instead on finding a solution.

Related: PRESS RELEASE: Financial Independence Group Ventures Into a Strategic Partnership With Tech Company Waterlily

The Details in the Data: How it Works

Before receiving their prediction, clients complete a three-minute intake form, answering basic demographic and medical questions. Using AI, the platform analyzes their personal family structure against others in the data set to show the client their likely trajectory of care.

The platform models the return on different funding options, including self-funding, long-term care insurance, annuities, hybrid policies, life insurance riders, and more. Using the first-of-its-kind policy upload feature, financial professionals can bring any policy to the platform, and it’ll quickly pull all relevant data into your client’s care plan, scanning and condensing a several-page document into a high-level summary of pertinent information that’s more digestible for clients to understand.

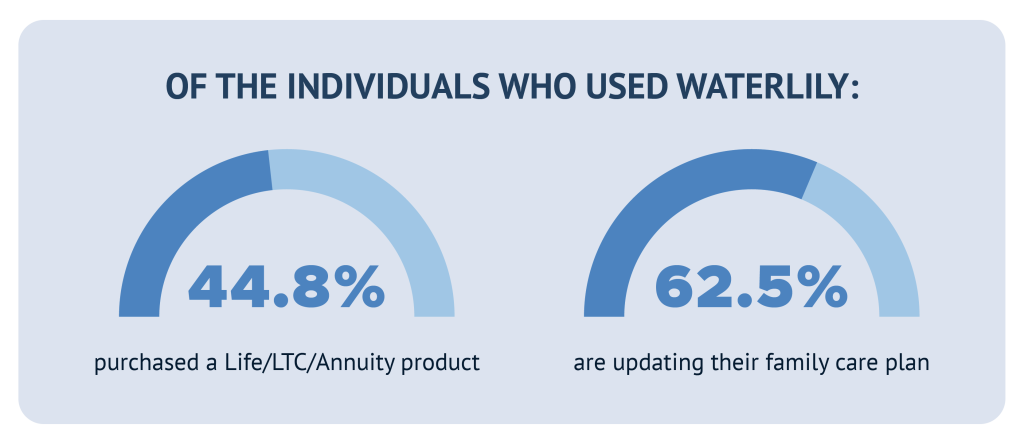

Waterlily is an excellent example of how financial professionals can leverage AI not just to enhance their own business but to revolutionize their clients’ financial plans. Lily Vittayarukskul recently took to social media to showcase her findings on how clients and financial professionals have benefited from the Waterlily platform.

AI is the Key to Staying Ahead

Embracing AI isn’t about jumping on buzzword trends—it’s about staying ahead in a rapidly evolving industry to improve your practice and provide unparalleled value to clients. AI is a force that, when harnessed the right way, has the potential to revolutionize many areas of your business.

Tools like Waterlily are just leading the charge.

Contact our Care Planning Division if you’d like to take advantage of a two-week free trial to see how Waterlily can transform your care planning business first-hand.