Using data to improve your practice is an important step in taking your business to the next level. That’s why we’ve surveyed over 100 clients on behalf of our advisors to gauge top concerns in the current landscape and provide insight into how you showcase yourself as a resource and an industry leader.

Relevant content is key to maintaining an engaged audience. While there’s more accessible content than ever before, audiences are still hungry for more, searching tirelessly for something that truly resonates with them. Whether your goal is to reach people through live events, webinars, or written content, covering the right topics will ensure that you become a trusted resource in your field of expertise.

Here are a few ways to leverage this top client concerns data that we’ll be covering:

- Promote a whitepaper or guide based on topics of interest

- Conduct a webinar or current challenges or top client concerns

- Develop marketing campaigns around hot topics based on how clients wish to be engaged

- Showcase yourself as a knowledgeable source for topics that concern clients most

The top client concerns and preferences we found through our client survey can inform and inspire your content to specifically tailor to your most coveted audience and showcase your business as the clear solution to their most fundamental financial challenges.

Top Client Concerns & Preferences

Concern #1: Not Having Enough Money in Retirement

About 54% of our survey participants said that when it comes to retirement, their biggest concern is not having enough money.

Retirement, almost by definition, is living without one’s accustomed income. Therefore, it’s no surprise that the majority of our respondents cited income as their top concern. For many, the problem is strictly mathematical – they can’t visualize how their lump-sum nest egg will translate into a sustainable income month after month.

For others, the issue is risk-centric; they may have a very detailed plan of how their savings should sustain them, but the risk of tax increases, market volatility, and inflation leave them feeling insecure.

Using case studies is a great way to demonstrate how various retirement plans provide income across a wide range of wealth. Case studies will not only allow you to feature a range of solutions but also allow your audience to easily relate to your presentation. Your case studies can be specific (as long as privacy and compliance requirements are met), or they can be hypothetical by creating a “conglomerate” based on multiple real-life examples.

Use examples from a narrow range of clients that fit the criteria you wish to represent and illustrate a solution that can suit this “category” of clientele. You can create as many as you feel is appropriate but remember to keep it simple and ensure that your case studies feel genuine and relatable to your audience. Most importantly, make sure that your particular process and business model is presented as an integral part of the solution that made their retirement a success.

Related: Ways to Get Clients Thinking About Multi-Generational Wealth Planning

Be mindful of which parts of your audience would benefit most from this information. It can be tempting to tailor your presentation to “the cream of the crop,” but only if retirement income is a real concern for this group.

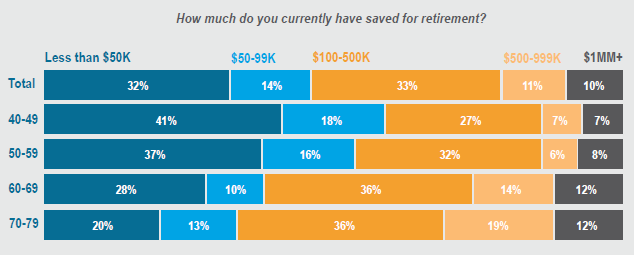

Tailor a presentation or whitepaper that dives into how one can plan a secure and prosperous retirement across these ranges of retirement savings. More importantly, demonstrate how your iron-clad process made that plan come to life.

Our survey participants indicated that they’re most concerned about retirement income (56%), reducing taxes (49%), and the election’s impact on their retirement (48%).

Engaging content is only as good as the topic it covers. Using your survey results to tailor your campaigns is a surefire way to demonstrate your expertise and showcase yourself as a resource. Time your content strategically to get the most use out of each topic that you cover.

Concern #2: Retirement Income

As mentioned in the previous section, case studies are a great way to tackle the topic of retirement income. Product-specific solutions are another effective tool you can leverage to showcase how your wealth management process can support your audience through retirement and beyond.

Some available resources on Marketplace One in the FIG Agent Portal are:

- 6 What If’s of Retirement presentation

- Retirement Budget Worksheet

- Preparing for a Satisfying Retirement whitepaper

- Looking at the Crystal Ball: Save Quickly But Save Safely with MYGAs whitepaper

Along with providing expert advice through articles, whitepapers, presentations, and events, don’t forget to leverage these topics through your digital avenues as well. If people are citing these topics as their top concerns, they’re also searching online for more information. Promoting your educational campaigns through social media can allow you to expand your audience vastly and efficiently.

Whether you choose to launch an online campaign, or simply use hashtags to promote your existing campaigns, be sure not to miss an opportunity to get the word out. If you’re publishing any content on your website, consider improving your SEO ranking by using keywords and metatags related to these topics.

Related: 10 Ways to Increase Your Social Media Reach & Engagement [Infographic]

Concern #3: Reducing Taxes

Any tax-focused campaigns will be most effective in the first quarter of the year when taxes are top of mind. Tax season is also a great opportunity to capture the attention of another crowd that doesn’t worry about tax consequences until it’s time to file. Providing your audience with updated tax tables is a fast and effective way to prove your value as a resource.

You can also consider hosting a shred day after the 2021 tax deadline, allowing your audience an opportunity to stop by your office to purge all those sensitive documents. Throw in a treat for increased participation! Something as simple as a charcuterie tray and a few sweet treats can increase engagement and act as a conversation starter during your event—it’s also a great opportunity to support a local bakery and tag them in your social media posts.

Concern #4: Impact of a New Administration

While the election didn’t rank the highest, the new administration will be top of mind for many investors in the months ahead. Since presidential elections only take place every four years (and we often don’t see a change in administrations for eight), it’s best to take advantage of this topic now. Luckily, Marketplace One has a few resources readily available such as a webinar presentation and a whitepaper that’ll allow you to capitalize on the opportunity to discuss and educate your audience on this topic.

Preference #1: Solutions-Based Financial Advice

In times of uncertainty, 70% of survey participants prefer financial advice that’s solution-oriented in protecting their financial well-being.

The overwhelming preference in terms of what type of financial advice respondents prefer during times of uncertainty is “solution-oriented advice.” When it comes to existing clients, offering solution-oriented advice is probably a natural part of your process.

However, are you effectively communicating your ability to provide solution-oriented advice through your marketing campaigns? Events, emails, and presentations often have catchy titles that may come off as more optimistic or leadership-oriented. Consider adding a sub-title or a header in your emails that clearly states how your content, consultations, and events will provide exactly what your audience has been searching for: clear solutions designed to protect assets and promote financial well-being. Then, make good on that promise.

Notice that “solution-oriented advice” is followed by “factual and informative advice.” Webinars, whitepapers, and workshops are great tools that combine both approaches, so make sure you’re promoting them with gusto!

Preference #2: Trustworthiness

65% of survey respondents indicated that trustworthiness is the most important trait they can look for in a local brand or organization.

Take a look at your marketing collateral. What aspects of your business have you chosen to feature? Perhaps you focus heavily on your process, solutions, or strategic partnerships—and while these are all worthy broadcasts, they may not be a priority for your client base.

Take a second look at your marketing materials from a consumer-lens and ask yourself if the message of trustworthiness is clear and consistent throughout your collateral. Also, ask what you can do to bolster this specific characteristic throughout your brand and marketing materials.

Here are a few qualities that can showcase your brand’s trustworthiness:

Transparency: People want to know what they can expect from your process and what your services will cost them, so be clear and upfront about your fees, your process, and your partnerships.

Referrals: The financial industry doesn’t lend itself to Yelp reviews and testimonials, yet these are largely how consumers decide how to spend their money in the current world of products and services. Referrals are the single most effective tool available to you in showcasing that your services are worth someone’s time and money.

The thing is, you have to ask for them. While some clients will refer their friends and family naturally, many will not. Make sure you have an iron-clad referral process in place and that you and your team use it religiously.

Accountability: Assurances go a long way in any business, but they can be difficult to define in a service-based industry (we don’t exactly have the space for a return policy). So, consider what assurances make sense for your particular business model and communicate them to your audience.

- Do your clients know that their calls and emails will be received and answered promptly and by whom?

- What measures does your team take to protect client data?

- Do clients know who in your office is responsible for providing statements or supporting their operational needs?

- Can they count on a quarterly review with you?

Make a pledge, create a schedule, or otherwise communicate how your offices uphold a sense of responsibility and accountability.

Related: The Financial Professional’s Inbound Marketing Funnel [Infographic]

Take action: Many consumers prefer to support brands that align with their societal views, a trend that’s increasingly common among millennials—the group that’ll represent the next wave of high-earners. Owning your brand’s moral compass doesn’t mean that you must broadcast your political views or take a stance on hot-button issues of the day. You can show support of causes through philanthropy or by taking simple measures in your office such as “going green” by cutting down on printing and single-use plastic. A small sign that says “we recycle” can be enough to show someone that you care about an issue that’s near and dear to their heart.

In terms of philanthropy, active involvement in one or two specific issues will provide an avenue by which new prospects (and existing clients) can connect with you. For example, you could support multiple fundraisers throughout the year to fight homelessness or childhood hunger. You can voice your involvement on your website, at your events, and in your newsletters.

Authenticity: Consumers can sense if your actions are contrived. Feigning support for an issue, evading direct questions about fees, or inflating the scope of your services will not promote an image of trustworthiness. Strive to represent your brand as completely and consistently as possible in everything you do.

Your content, your presentations, even your office vibe should purport a specific tone and brand. So, make sure to find your voice and define it with every person in your office, every email, and every marketing campaign.

Preference #3: How to Stay Informed

The participants’ most preferred ways of staying informed include speaking to an expert on the phone (22%), tuning in for a live webinar presentation (19%), watching an informative on-demand video (19%), and reading written articles and reports (18%).

The roughly even distribution of preferences tells us that offering a variety of contact methods is the best way to ensure engagement with your base. You may mistakenly be projecting your own preferences onto your audience; written articles might be your favorite way to engage, but don’t allow this to become your only (or even your default) outreach.

Get creative in how you choose to inform and engage your audience. Send a handwritten note thanking them for their attendance to your on-demand webinar, promote your written articles on social media, create invitations with incentives such as gift cards or free downloads for first-time consultations. Make sure you’re covering all your bases in your outreach efforts.

Parting Words on Addressing Top Client Concerns & Preferences

In this day and age, there’s no shortage of ways to connect with potential clients, but the availability and range of outreach platforms can be overwhelming. Take it step-by-step and remember to map out your marketing campaigns in advance. Plan who you want to reach, what deliverable you’ll use to reach them, and where you’ll promote that deliverable.

With this in mind, you can market more intentionally and strategically for a better rate of return and increased engagement with your priority audience.

Keep Reading: 8 Common Investment Mistakes to Avoid

The content within this document is for educational purposes only and does not represent an offer to buy, sell, replace or exchange any product. The content within this document does not represent legal, tax or investment advice. Customers should consult with their own legal or tax professional regarding their unique situation.